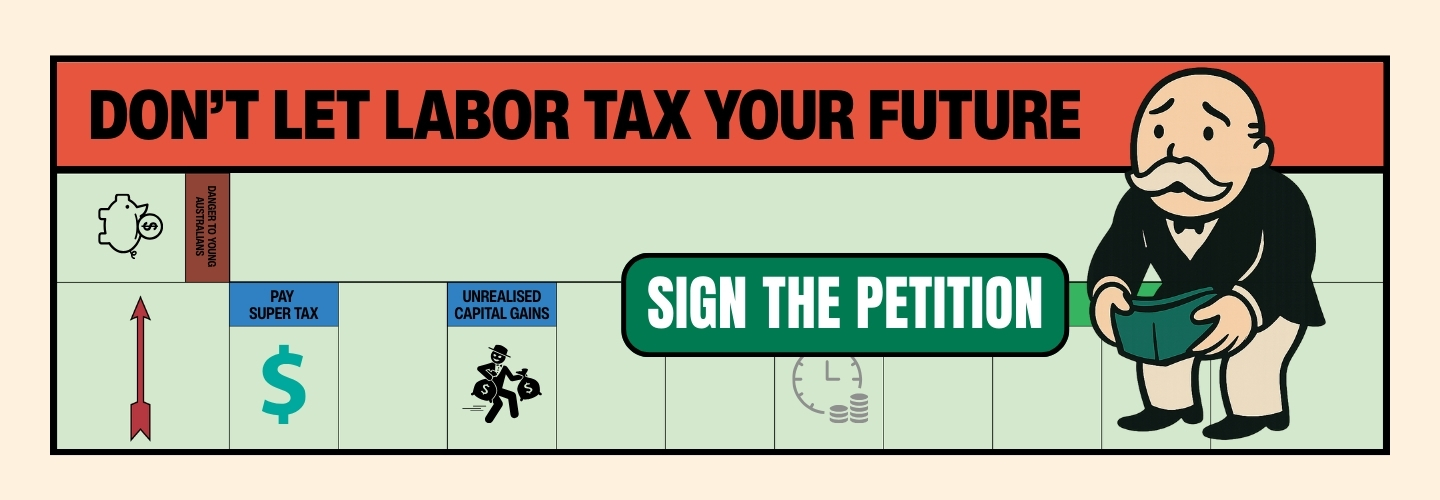

The Labor Government plans to double the tax rate on superannuation balances above $3 million and, for the first time, tax unrealised capital gains. This means you could be hit with a tax bill on paper profits before you have even sold an asset or seen the money.

That’s not even the worst part. The $3 million threshold will not be indexed to inflation. It may start small, affecting around 800,000 Australians now but as wages and investments grow, millions more young Australians will be caught in this tax trap over the next 30 years.

This is a long-term erosion of young people’s retirement savings, and once it’s in place, it is hard to undo.

Your superannuation is YOUR money. It should be protected, not taxed before it’s realised.

Will you stand with me and sign the petition to safeguard your future?